June 2024

tl;dr

- Still building in public, come check it out.

- So close to audits, but still navigating the last bits of complexity.

Development

The team is really kicking into high gear and we continue to make progress coding and refining the outstanding work. Every month we have a clearer picture of what is left to do, and it is so close we think we can grab it. It has been a tendency of ours to underestimate the complexity of what we are building, but we are running out of things we need to do. Some of the team has been working to clean up loose ends in preparation for starting audits. I am completely confident that we have built the team we need and continue to solve the problems we need to solve to finish strong. We continue to build in public and have bi-weekly reviews of what we are working on open to anyone in Discord.

This month we will be focusing on finalizing the details and grooming risk saturation protection and liquidation work. We have had a rough plan for this for a while, but the more detailed the plan became, the more thought was required about how to do it in an optimal manner. We need the code to run in constant time, we need it to not be overly restrictive, and we need it to protect against cascading liquidations. I have sought out feedback in the past from some of the more technically savvy investors and had our plan audited with ChainSecurity to make sure we were covering all the bases. The engineer we hired in March has taken the rough plan I had outlined and has been filling in the details and working out the kinks. This has been a huge relief as I am no longer the only person thinking about it. We are very close to having the final details on this completely worked out and I believe the implementation should be the easy part once the plan has been finalized.

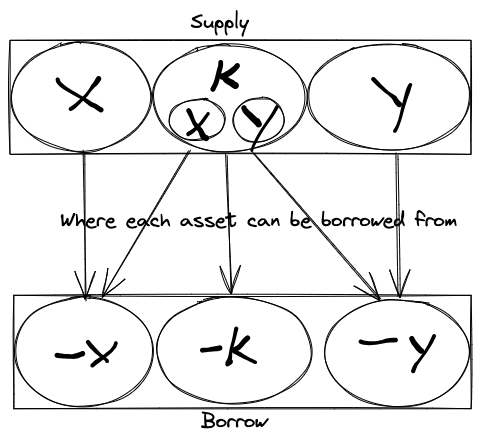

Interest rate work should also be completed. This was also something that I thought was going to be much simpler to implement than it has been. The relationships between the things that can be borrowed, X, Y, and L, and how that interest rolls up to the suppliers was not simple at all. We have worked out the worst parts of this. All of the interest and trading fees that roll up to market makers has been worked out and majority of it coded. The last bit is just coding the part where suppliers of individual assets earn interest from the borrowed assets. I think we can wrap that up this month and release new versions of the contracts on testnet with the added behavior.

Go to Market

We have received lots of positive feedback on the GTM strategy we outlined for Ammalgam and continue to iterate, remain agile, and improve the plan while initiating the ground-work necessary to launch the campaign when ready. We reflected on what we thought the team was still missing and are close to fleshing out the core marketing / business team. This is a rather short update given the team just returned from EthCC. We look forward to a more meaningful update next month. Once we are code complete and in audits, things will start moving very quickly on the go-to-market front. Right now, the team is deep in planning and focused on laying the groundwork on content, community, collaboration, etc. so when we hit "Go", we've got jacks or better.